When embarking on the journey to own a home, it’s important to familiarize yourself with the concept of mortgage pre-approval. Mortgage pre-approval serves as a preliminary assessment made by a lender to determine how much money you can borrow. This evaluation offers a realistic view of your purchasing power based on your financial situation. By understanding the process and components involved in mortgage pre-approval, potential homeowners can enhance their readiness to make a purchase and present themselves as reliable buyers to sellers.

There are several notable advantages associated with mortgage pre-approval, which make it an essential part of the home-buying process:

– Budget Clarity: With pre-approval, you gain insight into the loan amount you qualify for, which helps in setting a realistic price range for potential homes. This clarity allows you to focus your search on properties that are within reach financially, thus streamlining the home-selection process and reducing the likelihood of pursuing homes that are beyond your budget.

– Increased Seller Confidence: Sellers often favor buyers who come with a pre-approval letter in hand. This document is a testament to your financial readiness and sincerity in purchasing a home. It gives sellers confidence that you have the necessary backing to follow through on your offer. As a result, your offer could appear more attractive compared to others that lack similar financial assurances.

– Faster Closing Process: Since the lender has already assessed and verified your financial information during the pre-approval process, the final mortgage approval tends to be faster. This efficiency can significantly reduce the time taken to close on a home, reducing stress and uncertainty for all parties involved.

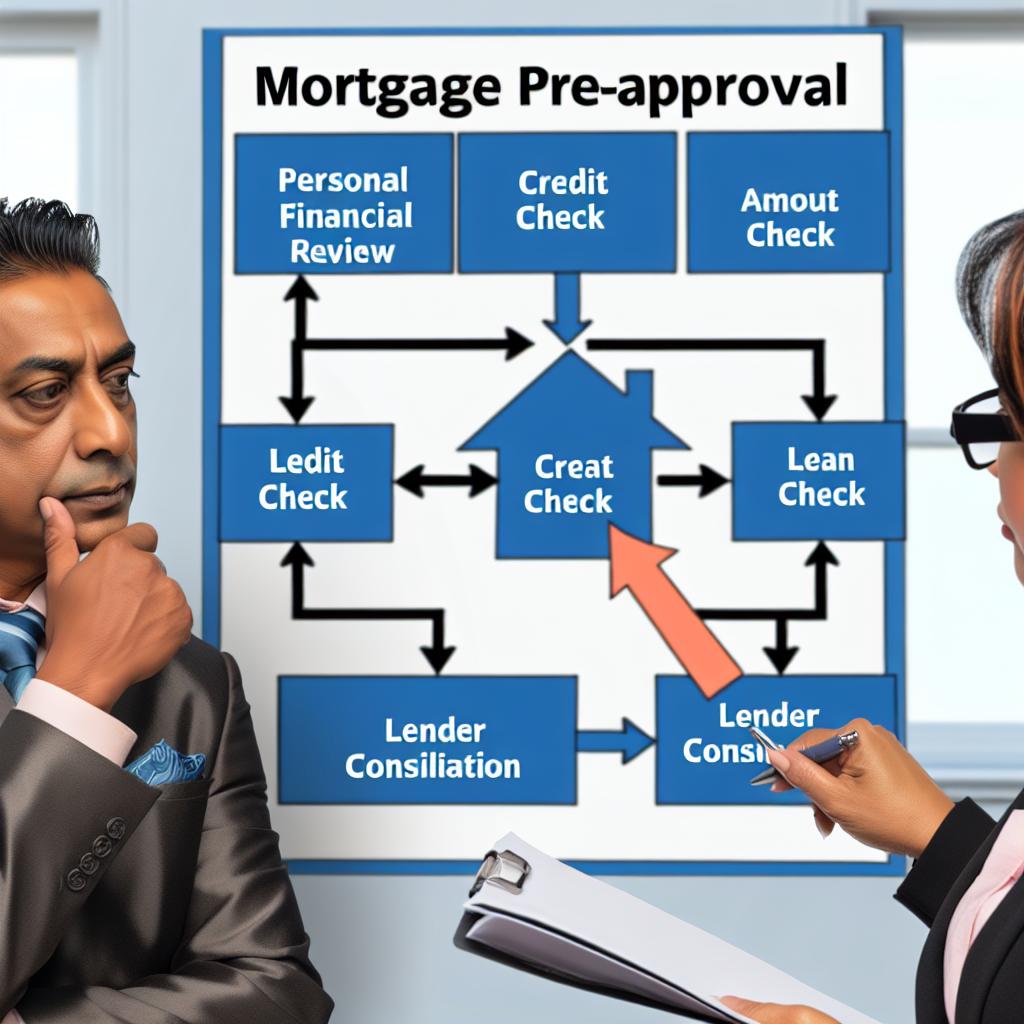

Understanding the process involved in obtaining a mortgage pre-approval is crucial. Here’s a detailed overview of the steps involved:

1. Financial Assessment: Before granting a pre-approval, lenders undertake a comprehensive evaluation of your financial health. This assessment includes reviewing your credit scores, income, debts, and assets. It’s beneficial to prepare accurate and current financial documentation, such as tax returns, pay stubs, bank statements, and other relevant records, which will expedite the process.

2. Application Submission: After gathering the necessary financial documents, you will need to submit a mortgage application to your chosen lender. This application contains personal and financial information, which serves as the basis for the lender’s assessment.

3. Credit Check: As part of their diligence, lenders carry out a credit check to understand your creditworthiness. This involves a detailed analysis of your credit history and existing debts. Ensuring your credit report is accurate and up-to-date before submitting your application is advisable, as this will allow you to address any discrepancies or errors that may negatively impact your creditworthiness.

4. Receiving Pre-Approval Letter: Upon successful assessment, if the lender is satisfied with your financial capacity, you will receive a pre-approval letter. This letter formally states the loan amount you are eligible for, and it can be used to demonstrate your serious intent and capability to sellers when making offers on a property.

It’s crucial to differentiate between pre-approval and pre-qualification, as they are distinct processes. Pre-qualification is often perceived as a preliminary step where you provide lenders with a general overview of your financial situation. Based on this information, lenders offer an estimated loan amount. However, pre-qualification is a less formal process and typically does not include a detailed credit check or verification of financial documents. Consequently, pre-approval is regarded as a more rigorous and reliable indicator of purchasing ability, aiding both the buyer and seller in the home purchasing process.

Several factors can significantly impact your mortgage pre-approval status:

– Credit Score: A higher credit score is advantageous when seeking pre-approval, as it suggests responsible credit behavior. A good credit score can enhance your chances of obtaining pre-approval on favorable terms.

– Debt-to-Income Ratio: This ratio is a measurement of your monthly liabilities relative to your monthly income. Lenders prefer a lower debt-to-income ratio, as it indicates a stable financial standing and a decreased risk of defaulting on future loan payments.

– Income History: Having a consistent and reliable income history is vital for demonstrating your financial stability to potential lenders. A proven track record of steady income can improve your pre-approval prospects and may lead to better loan terms.

In summary, mortgage pre-approval plays a significant role in the home-buying process by providing insights into your financial standing and boosting your credibility to sellers. It is a practical tool that helps manage expectations and facilitates a smoother transaction. To maximize the benefits of pre-approval, approach the process with organized financial documents and an understanding of the factors influencing your borrowing capacity. For anyone looking into further details or advice, exploring additional resources from mortgage lenders and financial advisors can be beneficial.

Comments are currently closed.